Environmental, Social and Governance (ESG) factors and criteria have never been more prevalent, particularly in the Insurance sector. While technological changes are reshaping products and markets, profound cultural shifts are also having a huge impact on the legitimacy and viability of businesses. Environmental and social concerns are now major drivers of consumer loyalty, brand strength and the acquisition of talent.

Where businesses in the past may have looked at a compliance or CSR mentality, now organisations are realigning themselves to be more purpose-driven.

Corporate purpose is at the heart of the leading corporate governance frameworks. Today, this goes well beyond mere stakeholder primacy. It is probably best defined by the British Academy: "profitably to solve the problems of people and planet, and not to contribute to them". Or, as Larry Fink puts it: "Purpose is not the sole pursuit of profits, but the animating force for achieving them."

It has never been more apparent that insurers and reinsurers around the world are displaying a deeper interest in Purpose and ESG factors. Some may argue that this is because regulators, such as the PRA, are imposing requirements on (re)insurers, others may argue it is because it makes good business sense. But whatever the reason, the rise of the prominence of ESG and Purpose is indisputable.

Most early adopters of ESG have typically been the large, European companies, but momentum is accelerating on a global scale. Exactly what embracing ESG and Purpose looks like for (re)insurers will largely depend on their individual approaches, but whatever happens, it is clear that 2021 is going to be an important year for ESG and Purpose in the (re)insurance industry.

In this series of five articles 'Global Insurance and ESG: Rising to the challenges of tomorrow', we will look at how environmental, social and governance considerations are affecting regulation and practice in the Insurance industry. We ask: what is the current regulatory landscape for sustainable finance in the UK, and what does the future look like? And what might this mean for insurers?

Why is ESG and Purpose important to businesses?

In our experience, businesses that take the time to understand and articulate their corporate purpose find themselves well positioned to identify and seize the opportunities presented by pivoting towards more sustainable and responsible business practices, while those that seek to address these through a compliance-led or purely risk management approach, incur more costs and struggle to unlock value. Addressing these issues impacts all aspects of a business - everything from their products, operations, and supply chain, to their governance and reporting. Therefore, a sophisticated contextual understanding of social, political and environmental factors, and the ability to spot risks to prosperity in the medium to long term, is more valuable to a business than ever before.

ESG analysis has become an increasingly important part of the investment process. Many investors are building ESG data into the investment process in order to gain a better understanding of the companies in which they invest. Likewise, many companies are finding that adopting and promoting ESG criteria improves performance. McKinsey reported in November 2019 that "A strong ESG proposition correlates with higher equity returns….." and that "Better performance in ESG also corresponds with a reduction in downside risk, as evidenced, among other ways, by lower loan and credit default swap spreads and higher credit rating."

Mishcon de Reya LLP views sustainability and ESG issues as indispensable board-level considerations for responsible, resilient and successful businesses. As a purpose-led business, we recognise that we are on a journey to achieving sustainability in everything we do.

What are the foundations for the current conversations on ESG and Purpose?

Whilst the drive in ESG and Purpose has gained more momentum over recent years, it is 2015 that marked a monumental shift in approach.

Finalised in 2015, the Paris Agreement and the United Nations 2030 Agenda for Sustainable Development (the 2030 Agenda) both represent universally approved policy visions. They both show a shift in approach from international mandates to country specific implementation processes, where governance relies on target and contributions set by individual countries.

The Paris Agreement and the 2030 Agenda are the bedrock on which many ESG conversations and initiatives are built.

For countries that have formally joined the Paris Agreement, it sees them submit a plan every five years, with the aim of increasing ambition compared with the previously submitted nationally determined contributions (NDC). The success of the Paris Agreement will depend on these strategic documents setting out each party's NDCs.

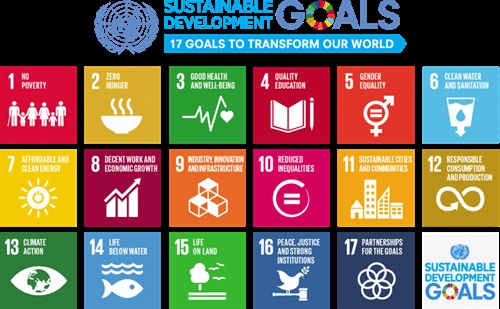

The 2030 Agenda was adopted by all 193 Member States of the United Nations in September 2015. It encompasses 17 Sustainable Development Goals (SDGs), 169 targets and some declaration text which sets out the principles of transformation, integration, universality and a global partnership. As stated in the UN Sustainable Development Goals report 2020 "The 17 SDGs demand nothing short of a transformation of the financial, economic and political systems that govern our societies today to guarantee the human rights of all". The SDGs are to be achieved by 2030.

The scale and ambition of, and the approach taken by, the 2030 Agenda are unprecedented. One of its key foundations is that the SDGs are global in nature and universally applicable, but that they take into account national realities, capacities and levels of development together with specific challenges. This means that all countries have a shared responsibility to achieve the SDGs, and all have a meaningful role to play, whether locally, nationally or on a global scale, but that the realities of those countries are recognised. There is no one size fits all approach.

Whilst the three goals most prioritised by business are: (13) Climate Action; (12) Responsible Production and Consumption; and (8) Decent Work and Economic Growth, the 17 SDGs cover a very wide range of areas.

What does this mean for the Insurance industry?

It has never been more apparent that insurers and reinsurers around the world are displaying a deeper interest in Purpose and ESG factors.

Some may argue that this is because regulators, such as the PRA, are imposing requirements on (re)insurers, others may argue it is because it makes good business sense. But whatever the reason, the rise of the prominence of ESG and Purpose is indisputable. Whilst firms are being encouraged to be bold in their ambitions regarding ESG, it comes as no surprise that (re)insurers do not like to 'go it alone', often preferring the 'safety in numbers' approach. Therefore, many insurers may look to embrace ESG, whilst being mindful of not straying too far from what others are doing.

Most early adopters of ESG have typically been the large, European companies, but momentum is accelerating on a global scale. It is felt that the recent political changes will likely add further pressure and it is believed that the US will make progress on catching up to Europe on climate change regulation in 2021.

Exactly what embracing ESG and Purpose looks like for (re)insurers will largely depend on their individual approaches. There have been several public announcements from (re)insurers on their individual targets for responsible underwriting and investment (with the most recent being UK insurer Aviva, who recently unveiled their plans to be a net zero carbon emissions firm by 2040) and it is likely that these announcements will continue throughout 2021.

In its first ever published Environmental, Social and Governance Report (published in December 2020), Lloyd's states that "….for the first time we are setting targets for responsible underwriting and investment to help accelerate society’s transition from fossil fuel dependency, towards renewable energy sources. Following feedback from and in consultation with our market, Lloyd’s will start to phase out insurance cover for, and investments in, thermal coal-fired power plants, thermal coal mines, oil sands, or new Arctic energy exploration activities. From 1 January 2022, Lloyd’s managing agents will be asked to no longer provide new insurance coverages or investments in these activities."

Whatever happens, it is clear that 2021 is going to be an important year for ESG and Purpose in the (re)insurance industry.

At Mishcon de Reya, ESG and Purpose is something that is very close to heart. Launched in 2020, Mishcon Purpose is Mishcon de Reya's new sustainability practice providing specialist advice and purpose-driven ESG insight to help our clients navigate the opportunities and risks presented by a complex landscape.

As lawyers, our first instinct is to look after our clients and their interests. In today’s rapidly changing and inherently uncertain world, we believe we do this best by being part of a wider community, which brings different perspectives to intractable challenges. Our community is strengthened by being part of networks and initiatives. For many of these, we are proud to be the legal partner, bringing our technical and professional skills as well as our passion. These include:

- The Chancery Lane Project

- Legal Services Alliance

- B Lab

- Athens Democracy Forum

In the next article of this series, Lydia Kellett explores the sustainable finance landscape in the UK. Sign up here to receive this next article.