In this article, Rhiannon Bail and Sakhee Ganatra at Mishcon de Reya look at the issues coming to the fore in this increasingly significant area.

British culture has long been reticent about openly discussing financial matters. But a new generation of millennial workers with different views and values about money and the workplace has begun to challenge this. This generational shift focuses more on a culture of inclusivity and openness and values a high degree of trust in the employer.

As we emerge from the pandemic, companies will face significant pressure to adopt an effective environmental, social and corporate governance (ESG) strategy. Pay transparency may well form one of the key "S" factors that companies look at when developing their ESG strategy.

Where are we to date?

There is currently no general legal requirement on employers to be transparent about pay. There are two statutory employment law provisions which touch on aspects of pay transparency:

- "pay secrecy clauses" are unenforceable to the extent that they seek to prevent an employee from discussing or disclosing pay when trying to identify potential pay discrimination; and

- employers with a headcount of 250 or more are required to report on their gender pay gap.

In recent years, as ECB readers are well aware, there has also been a strong corporate governance focus on pay transparency in the context of senior executive pay, with, for example, Companies Act requirements for larger companies being amended to require more disclosure of information about directors' remuneration. We are also waiting for the government's response to its proposals to introduce ethnicity pay gap reporting.

Public debate about pay transparency is becoming more and more common. A recent example can be seen in the 'Investigation into Unlawful Pay Discrimination at the BBC' report published by the Equality and Human Rights Commission, which emphasised that "…every employee should be able to see that their employer's pay processes are structured, well documented, transparent and kept under review".

In recent weeks, the European Commission has also proposed a number of pay transparency measures across EU member states (subject to approval), including the provision of pay information to job seekers and a right to request pay levels for those doing the same work.

Is pay transparency a good idea?

Recruitment and retention

Publicly disclosing salaries can help attract attention to an organisation. It may even enhance an employer's appeal in the context of both recruiting and retaining top talent, particularly in a competitive job market. Such transparency gives job hunters an early insight into the employer's core values, especially fairness and open communication, and suggests that staff are a valued asset.

Pay transparency may also help attract and retain a more diverse workforce. Unconscious bias can allow characteristics like gender, age and race to influence salary decisions, but greater transparency helps make decision makers more aware of their biases and so encourages them to be more objective in their decisions. Removing salary negotiation during the hiring or promotion process can also reduce the gender pay gap, as women are typically less likely than men to negotiate higher salaries: pay transparency helps level the playing field.

It is not unheard of for an employer's salary information to be in the public domain already. Companies such as Glass Door, PayScale and Salary.com already publish salary information and market comparisons using information provided by employees. It may benefit employers to control the narrative and information provided, whether that is promoting the positives in relation to salary matters or proactively committing to addressing the negatives. Employers may therefore welcome the opportunity to get ahead of the curve, and their competitors, by being more transparent about their pay structures.

While pay transparency can make an organisation more attractive to job hunters, there are potential downsides. Not only might publicly disclosing salaries encourage staff to look elsewhere if they discover they are paid below market rate, but there is the risk that competitors can use the information to solicit or poach staff with the lure of more favourable compensation packages.

It is also possible that pay transparency which focuses on salary rather than on the whole compensation package may provide a distorted picture. Employers offering a variety of soft benefits in addition to salary - for example more annual leave, insured benefits or a better work life balance - may therefore struggle to get a more nuanced message across.

Impact on employees and employers

Pay transparency can result in an increase in employee productivity. For more junior employees, seeing the salaries of those more senior to them can be motivating and can encourage them to strive to reach the next level of their career. However, where employees are shown the salaries of colleagues at a similar level to them, the reaction may not be as positive. In particular, if employees learn that they earn less than average compared to their peers, this can adversely affect their motivation and productivity.

Employers should also bear in mind that introducing pay transparency can cause some initial disruption. The novelty of finding out who gets paid what may lead to some employees being distracted and less focused in the short-term.

Pay transparency can also give rise to the risk of employment liability. Access to readily available pay information can lead to a rise in complaints, grievances and possibly even claims of pay discrimination. At present, the lack of information makes it more difficult for employees to learn of pay disparities, allege that pay practices are discriminatory, or identify suitable comparators for pay discrimination claims.

The flipside of this is that transparency can be the trigger that encourages employers to deal with pay equality issues head on, avoiding or at least mitigating the risk of claims and the resulting reputational damage.

How transparent should employers be?

Broadly, most employees want to know how their pay is determined and therefore how they can influence it, as well as how it compares with their peers.

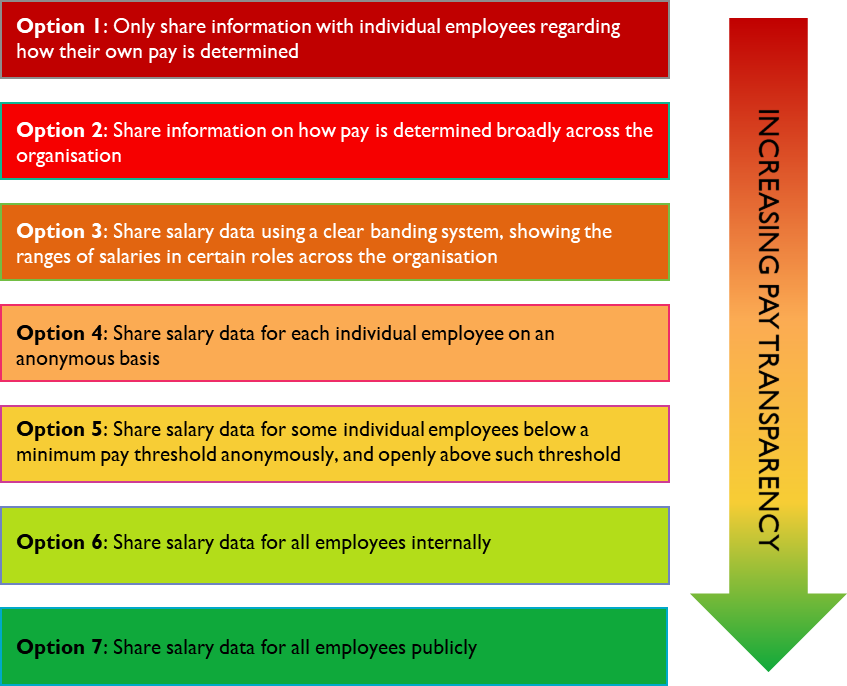

There are many options for employers as to how, and to what extent, such information can be shared. The sliding scale below considers various options, from the least to most transparent:

Which option an employer chooses depends on a variety of factors, such as:

- What does your data look like? Conducting a pay audit might be a sensible starting point, especially to get a sense of any areas of weakness.

- What records do you keep? Poor record-keeping often results in inconsistencies and uncertainty about what staff are paid, and why. This makes it difficult to objectively justify or otherwise defend differences.

- Which approach fits the culture of your organisation best?

- What do your employees actually want to know? Conducting employee surveys before taking any action may help determine which approach will be best received and have the greatest impact.

- Is there a market standard approach? For example, it is common in the UK legal sector for larger law firms to publish salary band data, at least for trainee lawyers and newly qualified solicitors, with less transparency (and greater discretion) being reserved for more senior lawyers.

- What are your competitors doing? Do you need to 'keep up'? Alternatively, do you want first-mover advantage?

- What information can you legitimately disclose from a legal perspective? For example, before disclosing individual employees' salaries, careful consideration needs to be given to the employer's data privacy obligations.

Regardless of which option is chosen, what is crucial is that the employer's compensation system be fair and equitable, properly managed and well communicated.

What are other companies doing?

Whole Foods

The health-food supermarket, Whole Foods, was one of the earliest movers in the pay transparency space. It introduced pay transparency in 1986, just six years after the company was established. With approximately 91,000 employees, Whole Foods is one of the largest companies making its pay details transparent. Whole Foods makes available the average pay for the different professional titles across the organisation and it is reported that employees can see salary data for others throughout the company by making an appointment with a human resources manager. John Mackey, CEO of Whole Foods, is a strong believer in disclosing pay information because he thinks that it makes employees work harder and strive for the next level. Mackey also argues that if inequalities do become apparent, people can complain about it, giving the company an opportunity to correct itself. On the other hand, if the pay is justifiable it allows the company to use it as an opportunity to point out what Whole Foods values and rewards the most.

Buffer

Buffer is a social media management tool company with around 90 employees based in the US. Buffer has become well-known for the radical approach it has taken to pay transparency – making a spreadsheet of its employees' salaries publicly available on its website (see extract below).

A full list of all our salaries

Calculated with the new formula, here are the salaries of every team member at Buffer right now:

|

Team Member

|

Role

|

Start Date

|

Location

|

Salary

|

| Joel |

CEO |

2010-08-01 |

New York, NY, USA |

$218,000 |

| Leo |

COO |

2011-01-03 |

New York, NY, USA |

$185,000 |

| Andy |

iOS Developer |

2012-06-01 |

San Francisco, CA, USA |

$168,550 |

Also publicly available is the formula that Buffer uses for creating salaries. This formula is reviewed by the company every two years. It includes factors like the employee's role, experience, loyalty to the company, stock options and the cost of living in the area where the employee is based. There are no salary negotiations and no bonuses are offered by the company. The Buffer website even has a calculator that prospective employees can use to check what their salary would be if they worked there.

In the month after making its salaries public, Buffer received twice the number of job applications compared to the previous month. Buffer also reported a 94 percent retention rate and a turnover rate of 5.8 percent in 2018.

It is clear that Buffer's approach is reflective of the wider values of the company and the desire to become a completely open company, with transparency as the default. Buffer believes their approach to pay transparency has helped boost trust, morale, workplace happiness and productivity.

What can we expect in future?

It is evident that increased pay transparency can bring real benefits to an organisation when it comes to recruitment, retention and employee productivity. However, employers will understandably have reservations about how best to implement pay transparency in practice. There is certainly no one-size-fits-all approach: employers need to carefully consider which option on the sliding scale works best for them and their workforce. Pay transparency is by no means a stand-alone fix but it may go some way towards demonstrating that the organisation's pay system is fair and trustworthy.

While the extent to which UK employers will embrace pay transparency remains to be seen, it is clear that the pandemic has further accelerated the value that the new generation of employees places on openness and trust between employer and employee. As the UK emerges from the pandemic, pay transparency may well be a key aspect of how employers "build back better" for the future.